Unleash the Full Potential of Your Business

PLUTUS

General Insurance

Third Party vs. Comprehensive Car Insurance in Singapore: Which Is Right for You?

Why Choosing the Right Car Insurance Matters in Singapore

Car insurance in Singapore isn’t just a legal requirement. It’s a crucial financial decision. With the high cost of vehicle ownership (thanks to rising COE prices and maintenance fees), picking the wrong policy could leave you either underinsured or overpaying for unnecessary coverage.

In this guide, we’ll break down the differences between third party and comprehensive car insurance in Singapore, compare average costs, and help you decide which option best suits your needs and driving habits.

What Is Third Party Car Insurance?

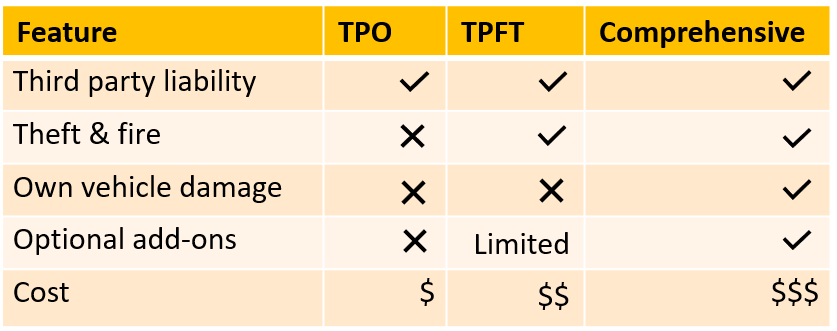

Third-party only car insurance (TPO) is the most basic form of coverage available in Singapore and the minimum legal requirement for all drivers.

What It Covers:

What It Doesn’t Cover:

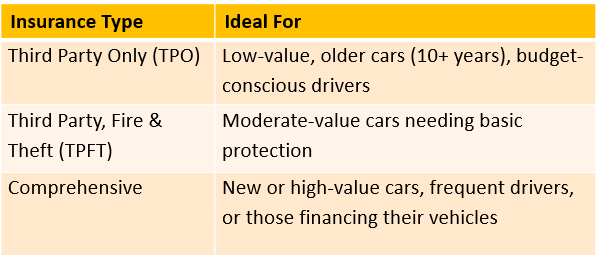

Best for: Vehicles over 10 years old, low resale value cars, infrequent drivers.

What Is Comprehensive Car Insurance?

Comprehensive car insurance provides all the benefits of third party insurance, plus coverage for your own vehicle.

What It Includes:

Best for: New cars, cars under financing, daily commuters, safety-conscious drivers.

Third Party vs. Comprehensive: How to Choose the Right Policy

Many comprehensive plans offer customizable add-ons. While optional, some of these benefits offer significant value.

Ask Yourself:

Quick Decision Guide:

Third Party vs. Comprehensive: How to Choose the Right Policy

While TPO may seem like a money-saver, cutting corners on coverage can backfire, especially during accidents or emergencies.

Real-Life Scenarios:

Underinsuring could cost you more than you think.

Add-Ons That Can Enhance Your Coverage

Many comprehensive plans offer customizable add-ons. While optional, some of these benefits offer significant value.

Recommended Add-ons:

Quick Comparison: Coverage at a Glance

Frequently Asked Questions (FAQs)

Choose Insurance That Fits Your Lifestyle

The right car insurance isn’t just about price. It’s about protection, peace of mind, and preparedness. If you’re driving a newer car, using it daily, or financing it, comprehensive coverage offers unmatched value.

If you’re behind the wheel of an older vehicle or rarely drive, third party or TPFT may be sufficient, but stay in the know about the risks.

Make an informed decision today. Contact Plutus to get a competitive quote for your car insurance policy.