Unleash the Full Potential of Your Business

PLUTUS

Accounting

Setting Up an Accounting System in Singapore | 2025 Guide

As a new business owner in Singapore, your focus is on growth, innovation, and building your client base, not on navigating spreadsheets and tax codes. Yet, an inefficient or non-compliant accounting system can quickly lead to IRAS penalties, crippling cash flow problems, and unnecessary stress. What many entrepreneurs discover too late is that a robust accounting system isn’t just a legal requirement – it’s the strategic foundation that supports sustainable growth.

Our comprehensive guide will walk you through the entire process of setting up a fully compliant, efficient, and scalable accounting system tailored for Singapore’s unique regulatory environment. Whether you’re a solo founder or a growing SME, you’ll learn how to build a financial infrastructure that saves you time, keeps you on the right side of the law, and provides the insights you need to thrive.

Why a Singapore-Compliant Accounting System is Your Best Business Investment

The 5 Pillars of a Rock-Solid Singapore Accounting System

Choosing Your Tool: Software vs. Outsourcing in Singapore

This is the core decision for most business owners.

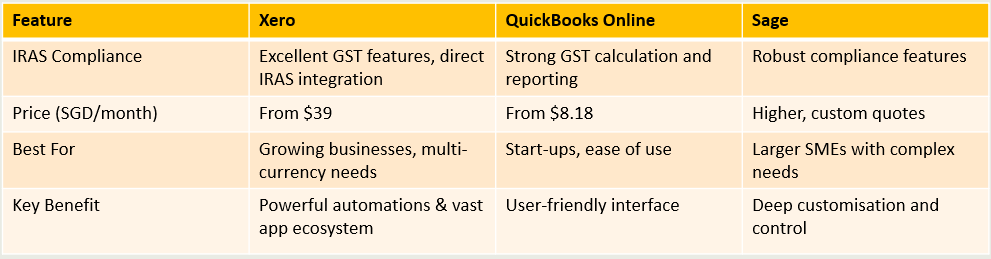

Xero: Often the top choice for its powerful automation, beautiful interface, and extensive ecosystem of integrated apps (e.g., for payroll, inventory).

QuickBooks Online: Known for its user-friendliness and intuitive design, making it a great starting point for first-time users.

Sage: Offers more advanced features and customisation, suited for businesses with more complex inventory or manufacturing needs.

When to Hire an Accountant or Outsource

Your 6-Step Implementation Plan

Common Pitfalls to Avoid

Build Your Foundation for Growth

Setting up your accounting system correctly from the start is one of the most impactful investments you can make in your Singapore business. It transforms accounting from a dreaded chore into a powerful engine for insight and growth. By choosing the right tools and following a structured process, you ensure compliance and gain control over your finances.

Ready to build a financial foundation you can trust?

Schedule a consultation with our accounting experts at Plutus to find the perfect solution for your business needs.