Unleash the Full Potential of Your Business

PLUTUS

Company Secretary

Dividend Rights in Different Share Classes in Singapore | 2025 Guide

Dividends are one of the primary ways shareholders benefit from owning a stake in a company. But not all shares are created equal, and in Singapore, the rights to dividends vary depending on the class of shares a company issues.

For business owners, structuring the right share classes can help attract investors, retain control, and maintain compliance with the Companies Act. For investors, understanding dividend rights is crucial to knowing when and how much they can expect to be paid.

This guide explains the different dividend rights across share classes in Singapore, including legal requirements, priority of payments, and key considerations for both companies and investors.

Overview of Share Classes in Singapore

Clearly document specific rights, especially dividend entitlements, in the constitution to avoid disputes.

Dividend Rights of Ordinary Shares in Singapore

Ordinary shares are the “default” class of equity in most Singapore companies.

Key Features:

Investor Perspective:

Dividend Rights of Preference Shares in Singapore

Preference shares are popular with investors because they provide priority dividend rights. They’re often structured as a middle ground between debt and equity.

Types of Preference Shares and Their Dividend Rights:

Dividend Priority and Distribution Order

-

1

Creditors

-

2

Preference Shareholders

-

3

Ordinary shareholders

Legal & Regulatory Framework in Singapore

Dividend rights must comply with the Companies Act 1967 and be documented in the company’s constitution.

Key Legal Points:

Practical Examples & Case Scenarios

Dividend rights must comply with the Companies Act 1967 and be documented in the company’s constitution.

Key Considerations for Companies and Investors

For Companies

For Investors

FAQs on Dividend Rights in Singapore Share Classes

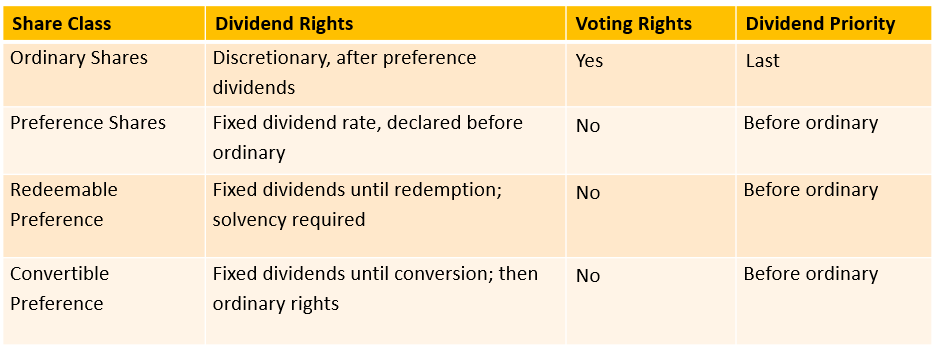

At A Glance: Dividend Rights Across Share Classes in Singapore

Structuring Dividend Rights Wisely

Dividend rights in Singapore depend heavily on the class of shares issued. Ordinary shareholders have discretionary and variable entitlements, while preference shareholders enjoy fixed or preferential dividends, often at the cost of voting power.

For companies, the right share structure can balance investor expectations with financial flexibility. For investors, understanding dividend rights ensures you know exactly when and how you’ll be rewarded.

Next Step: If you’re considering restructuring your company’s shares or investing in one, consult a corporate advisor to ensure dividend rights are structured in line with your goals and legal requirements.

Plutus’s Corporate Secretarial team specializes in company structuring, share issuance, and compliance with ACRA regulations. We simplify complex legal requirements, protect shareholder interests, and help businesses grow with confidence.

Contact us today to structure smarter, stronger share classes for your company.