Unleash the Full Potential of Your Business

PLUTUS

Tax

Singapore Individual Income Tax Rates for Residents and Non-Residents | 2025 Guide

Introduction: What’s New for YA 2025?

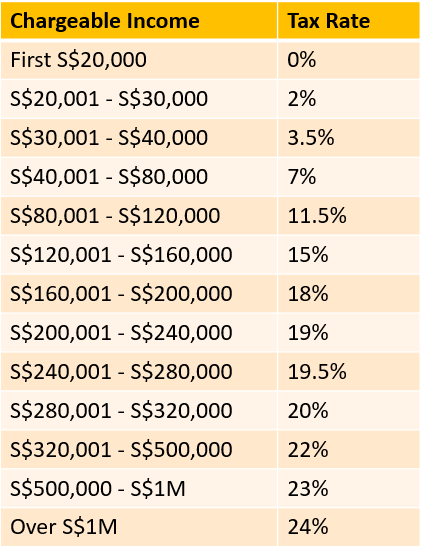

Singapore’s tax landscape is evolving. For the Year of Assessment (YA) 2025, individuals will face a higher top marginal tax rate of 24%, along with a generous 60% tax rebate (capped at S$200) for eligible residents. This guide explains the updated personal income tax rates, residency rules, relief options, and filing updates so you can minimize your tax bill and file with confidence.

Updated Income Tax Rates for Individuals (YA 2025)

Tax Residency: Why It Matters

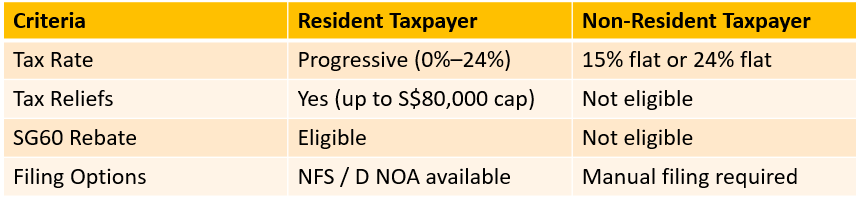

Your tax residency status determines your applicable tax rates, eligibility for reliefs, and access to rebates.

Who Qualifies as a Tax Resident?

Tax Rates Based on Residency

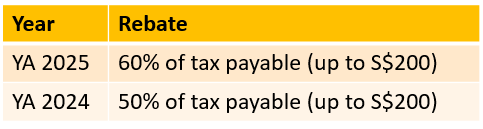

SG60 Tax Rebate for YA 2025

In celebration of Singapore’s 60th birthday, tax residents will receive an automatically applied 60% rebate on tax payable, capped at S$200.

Simplified Tax Filing: NFS & D‑NOA

What’s New in Tax Filing for 2025?

Post-Rebate Tax Calculations

Let’s look at a simplified scenario:

Example 1: Middle-Income Earner

Example 2: High-Income Earner

How to Maximize Tax Reliefs (Cap: S$80,000)

Tax residents can claim up to S$80,000 in total personal reliefs. Here are the most impactful categories:

Retirement & Savings Reliefs

Family-Related Reliefs

Other Common Reliefs

Residents vs Non-Residents: Quick Comparison Table

File Smart, Save More

By understanding your tax residency, leveraging available reliefs, and verifying your filing status, you can take full advantage of Singapore’s tax framework. Maximize your Singapore income tax savings for YA 2025 by understanding updated rates, utilizing tax reliefs, and filing on time.

Unsure how the new tax rates and rebates affect you? Plutus’s experienced tax advisors will assess your situation, file accurately with IRAS, and help you benefit from all available rebates and deductions for YA 2025. Contact us for a consultation now!